Genesis

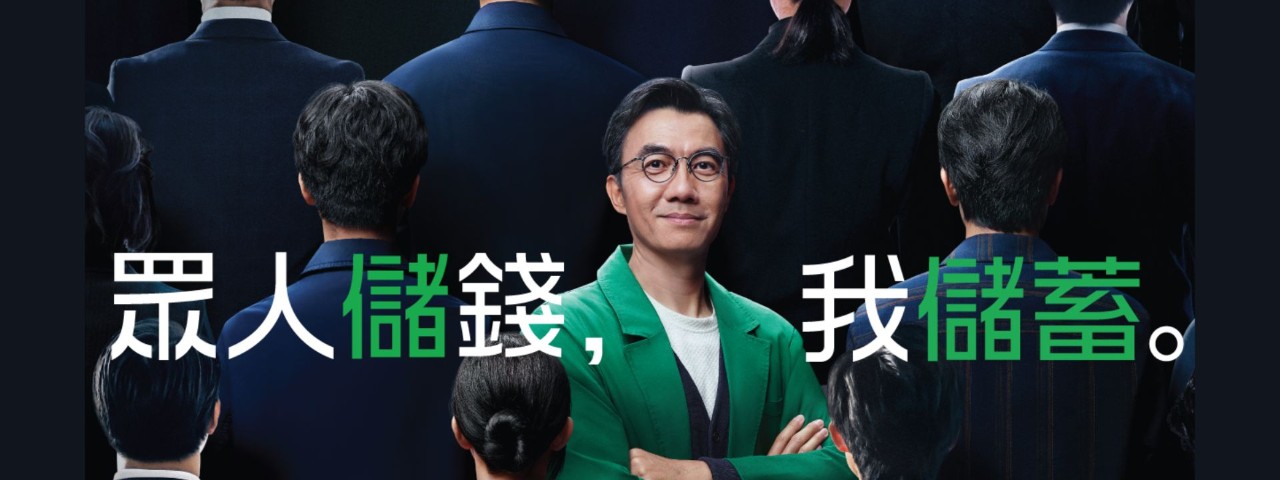

Ben Sir: “Money saving” and “savings” are not the same

In fact, “Money saving” and “savings” have different meanings. “Money saving” is to prepare for unknown future, relatively passive; “Savings” is about preparing to fulfill your desired plans, actively. Change your perspective with Manulife, by encouraging you not only to “money saving”, but to do “savings”! Take the initiative to seize every opportunity to create "possibilities"!

Are you still worrying about running out of money before payday?

What is Genesis?

Genesis provides long-term potential return that is complemented by flexible withdrawal options to meet your liquidity needs, an advance benefit for designated critical and mental illnesses, plus a currency switch option to support your future planning. At the same time, we can help you craft an enduring legacy with enhanced flexibility. With Genesis, a truly rewarding future begins today.

The content of this website does not contain the full terms of the policy(ies), and the full terms can be found in the corresponding policy document(s).

How we got you covered?

This website shall be read in conjunction with the relevant product leaflet. You should not purchase any product solely on the basis of this promotional offer . Please ask your Manulife insurance advisor for a copy of the product leaflet which will give you more details about the product including the ‘Important Information’ showing the product risks.

Before making a purchase, you should read the policy provisions for the exact terms and conditions that apply to this product. You can ask us for a copy.

Important Note

Genesis is an insurance product provided and underwritten by Manulife (International) Limited (incorporated in Bermuda with limited liability). The above provides only general information on this product for your reference only. Please download the product leaflet now or ask your Insurance/Financial Advisor for a copy which will give you more details about this product including the ‘Important Information’ showing the product risks.

Remarks

^ Applicable to USD single premium policy . This figure is not guaranteed.

* Take for example, the total internal rate of return at the end of 100th policy year for a USD policy in 5-year premium payment term. This figure is not guaranteed.

^ and *also assume that throughout the policy term, (i) no Body and Mind Advance Benefit has been exercised; (ii) no policy loan is taken out; (iii) no currency switch option has been exercised; (iv) no Easy Choice or Realization Option has been exercised; (v) no withdrawal is made through the reduction of notional amount; and (vi) no premium holiday has been exercised; and all premiums are paid annually in full when due.

@ Only applicable to designated plans issued in Hong Kong, and application will be accepted from Q3 2024. The full name of Legacy Choice is named as Successive policyowner (with Legacy Choice). This is an administrative arrangement and is not part of the product features. Such application is subject to our prevailing administrative rules which shall be determined and modified by us from time to time without prior notice.

# Terms and Conditions apply.

- The terminal bonus is not guaranteed. We will review and adjust the terminal bonus at least once a month, but we may do so more often. Terminal bonus will not be payable upon the death of the life insured if the sum of the guaranteed cash value and terminal bonus is less than the aggregate sum of premium due and paid. Please see ‘The main risks affecting the non-guaranteed terminal bonus, non-guaranteed income and the accumulation interest rate of non-guaranteed income / realized terminal bonus’ paragraph in the ‘Important Information’ section of the product leaflet.

- To set up Easy Choice, you must submit a written application in a prescribed format required by us to select an Income Start Anniversary, income payment option and income payment mode upon policy application or after the 1st policy anniversary. The non-guaranteed income is determined from time to time by us at our sole discretion. Exercising this payment option will reduce any future terminal bonus. The Income Start Anniversary, income payment option or income payment mode is allowed to be changed after the 1st policy anniversary. The change will be made effective at the subsequent policy anniversary.

For single premium policy with the Income Start Anniversary set as the 1st policy anniversary, change of Income Start Anniversary and change from Easy Choice to realization option are not allowed. You may only apply for suspension and restart of income payments and change of income payment option and income payment mode after the 1st policy anniversary.

Once submitted, the application for the setup or change cannot be withdrawn or reversed. The non-guaranteed income will be adjusted based on the new selection. Please see the policy provisions for more details and rules on the setup and change of Easy Choice. - You can exercise the realization option within 31 days from the Realization Anniversary (that is, the 5th policy anniversary or every anniversary thereafter) as long as the aggregate realization percentage under the policy over any consecutive 5 policy years does not exceed 50% and for the first 5 policy years following the first Realization Anniversary, the aggregate realization percentage for each of the policy year shall not exceed 10%. To exercise the realization option, you must submit a written application in a prescribed format required by us. Once submitted, the application for exercising such option cannot be withdrawn and no realized terminal bonus will be allowed to be reversed. Exercising the realization option will reduce any future terminal bonus.

- The Body and Mind Advance Benefit can be exercised 1 year after the later of the issue date or the policy year date. Exercising the Body and Mind Advance Benefit may significantly reduce any future terminal bonus and non-guaranteed income (if any). For the avoidance of doubt, the realized percentage of the terminal bonus under Body and Mind Advance Benefit will not count into the aggregate realization percentage under the realization option. Please see the ‘Body and Mind Advance Benefit Provision’ for the definition of the designated illnesses, and the terms and conditions for the Body and Mind Advance Benefit and ‘Elimination period’ under ‘Important Information’ section of the product leaflet.

- Starting from the 3rd policy anniversary, you can change the policy currency once per policy year by converting your plan to a designated Manulife’s plan (may or may not be the same as Genesis) that is available in your chosen currency. The application for currency switch must be made with 31 days from a Currency Switch Anniversary and meet the required conditions and is subject to our prevailing rules and approval of the application at our sole and absolute discretion. Please refer to the product leaflet for the conditions and impact of exercising currency switch option and ‘Risk from exercising the currency switch option’ paragraph under the ‘Important Information’ section.

- Starting from the first policy anniversary or 1 year after the policy is issued, whichever is later, you have an option to change the life insured to another person with whom you have insurable interest, without affecting your policy value, provided that:

i. the age of the new life insured is 60 or below; or

ii. the age of the new life insured is not greater than that of the current life insured and is not greater than 80; and

iii. such application must be completed during the lifetime of both current life insured and new life insured.

Acceptance of such application is subject to our approval at our absolute discretion as well as our prevailing administrative rules and guidelines which we may determine from time to time at our absolute discretion. Once the change of life insured is effective, all supplementary benefits (if any) shall be automatically terminated.